Crises, yes crises, we have seen a few in recent years. After the first financial crisis, 2009, the COVID-19 crisis and now the energy crisis, , they all have cost us respectively 1.6%, 2.5% and lately a whopping 7.8% of GDP loss according to Tom Krebs (Uni Mannheim and FNE) in his assessment of lessons from these crises. Also Philip Lane (ECB) showed the lower GDP growth rates due to the crises.

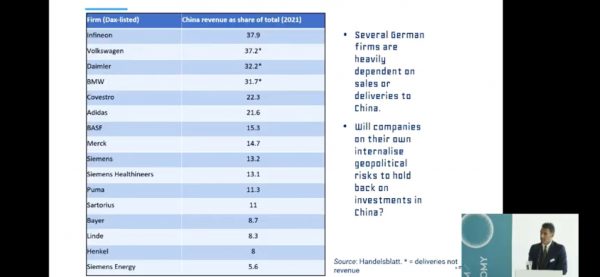

We lost out on the wealth of our nations and face mounting difficulties for the distribution of this wealth. As firms cashed in on profit margins lately, workers risk even more to fall behind significantly. At the same time, it is high time to prepare for the next winter season now, to ensure the same risks as the dependency on energy resources from outside Europe, especially Russia, can be maintained. The conference of the Forum New Economy from the 8th of May 2023 discussed several ways forward to learn our lessons from these crises. Strategic independence needs to be properly defined for Europe as a whole, not just in each individual state. Implementation has to be rapid as well. Geopolitical challenges will not wait for us to finish discussions. Germany and minister Robert Habeck has received some acclaim from the economists for a fast and rather successful reaction to safe us from an energy crisis last winter. Massive increases in renewables (+20% solar energy) has helped a lot to ensure sufficent energy supply when France suffered heavy reductions from its nuclear energy power plants. “Let the sun shine … in”, I would sing. However, we have to think even further ahead build our resilience based on improved energy efficiency and may rethink the risks and vulnerabilities of our economic model of production and consumption. Diversifying imports from Russia with imports from other countries and other (green) forms energy is part of the solution. A heavy reliance on China as buyer of our products is good for trade balance, but some sectors (automotive) are nowadays critically dependent on selling in China. Some of our partners are very anxious about this new dependency on Asia for our economic growth model (see figure below from conference). Market based economies suffer more openly from huge economic swings than more secret-based autocratic economies. Our state agencies have to keep that in mind and state intervention seems to become more likely options in future as we have already witnessed in the past crises. We had to rely on running higher state deficits to cover the losses incurred from the crises. The EU, the larger Europe in combination with the transatlantic and pacific alliances has a lot of resources to address these strategic interdependencies. Being prepared, in strategic thinking and potential implementation procedures is a major part of building capacities that ensure resilience and strategic independence. As in a game of chess, you have to think ahead a couple of steps to frighten off some potentially dangerous moves of other players.

In terms of a planetary concern we still have to address the major climate crisis and the last 3 crises have largely contributed to reduce the resources we have available to address climate change. Smart crisis management succeded to ask for emission reductions in return for subsidies from firms and private households. This might be the “best practice examples” worthy to learn from. There are still huge evaluation tasks for analysts of these crises.