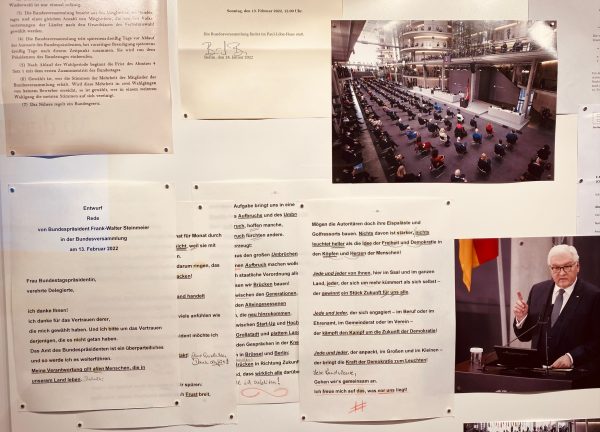

At the occasion of a visit to the “Deutsche Dom” in Berlin, which hosts the historical exhibition of the “Deutsche Bundestag”, I came across the memorable transcript of the speech by Bundespräsident Steinmeier (Image below), which he gave on 2022-2-13. The German President’s words come across as a forceful defense of freedom and democracy as a matter of mind and heart, and against the authoritarian leaders who keep constructing palaces of ice and golf resorts. (“Mögen die Autoritären doch ihre Eispaläste und Golfressorts bauen. Nichts davon ist stärker, nichts leuchtet heller als die Idee der Freiheit und Demokratie in den Köpfen und Herzen der Menschen!”, p.18). There is indeed an ongoing battle on which kind of diplomacy is more effective, words or playing golf together. Apparently the Finnish prime minister seems to be quite keen to play balls with President Trump on the golf course to ensure continued support of the 1000 km Russian Finnish border. Maybe, playing Ping Pong with the Chinese leadership might be more effective in balancing the trade books between Europe and China, just as much as golfing might do the trick with the current Trump administration. What’s your handicap in the golf and ping pong tournament of international politics.