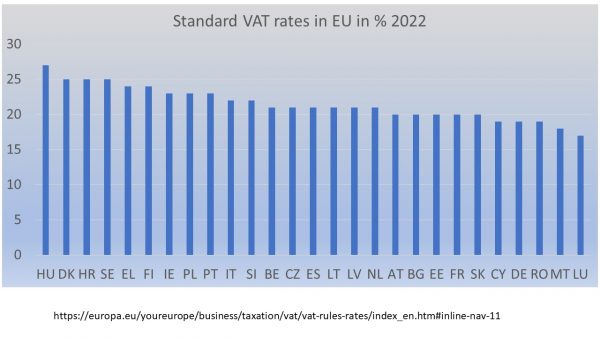

From time to time it is helpful to compare basic tax rates, for example value added tax, across the EU to understand the different economic and social policy approaches. The range of VAT from Hungary 27% to Luxembourg 17% is astonishing and it does not really feel like we are together in a common market. Okay, the illiberal, authoritarian state of Hungary is taxing the most, a clear message to visitors from another European country that this authoritarian state is relying on tax on consumption of its own people and visitors to foot the bill of state expenditure.

It is also interesting to realise that some countries with lower VAT rates have disproportionate public debates about supposed tax burdens. Tax levels are a political choice and much depends on redistributive appropriate use of tax receipts to the benefit of all or specifically those most in need. The potential for redistribution to parents, children, pensions, the poor or green investments also relies to some extent on the overall budget. The most surprising thing is the absence of a debate about tax rates, the size of the tax base and the ample exemptions or reduced rates. Of course, most of us complain about income taxes, but we all agree that it is nice to see that someone is taking care of the abundant autumn leaves or lighting of streets in the darker seasons. Even Adam Smith wrote in favour of the “night-watch state” that assures sufficient security levels. Taxing Europe to ensure that this role of the state can be taken seriously is still a common denominator across Europe.

Image: own presentation based on EU-data from 2022 LINK.