Yes of course, Central Banks will use AI, and some do so already (Kazinnik and Brynjolfsson, 2025). Beyond the standard application of AI by its employees, there are many potentials to use AI to analyse and publish data at a faster rate or in order to detect financial crimes. Similarly, data collection based on webpage harvesting might yield new indicators of inflation, expenditure for environmental risks (heat waves, flooding etc.) earlier and in addition to the normal set of indicators. Hence, Central banks might be better and faster in forecasting inflationary tendencies using more AI tools in their daily routines. Of course, it is difficult to predict a disruptive tariffs policy of a major economic player in the world economy, but the calculation of more, even hallucinatory scenarios become more feasible. It is feasible to weigh overall risks of different scenarios to the economy.

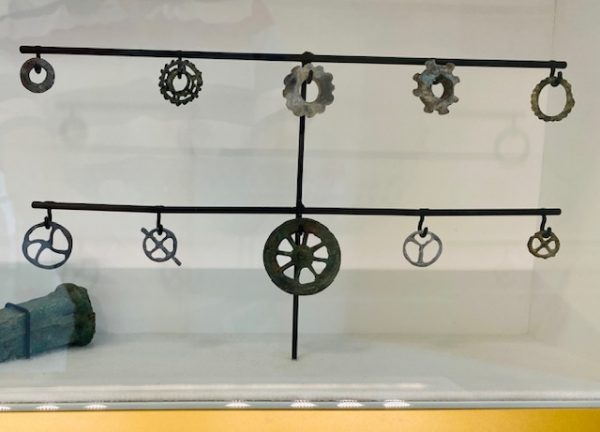

(Image: Celtic coins, Museum of the Belgian National Bank)