A political theory in the area political economy is prone to be labelled as classical, neo-classical, Keynesian, Neo- or Post-Keynesian or heterodox economics. This is a university level course in the history of economic ideas, if you like this. Let’s try something creative here. We have unprecedented levels of inflation currently in Europe and many other parts of the world. Reasons for this are higher prices for energy, transportation and food. Anything else you need for life? You must be an artist or a priest, a bit off the normal, it seems to many economists. Add to this that, we want to foster strategic autonomy in Europe rather than anything from China that is cheaper and more polluting. In 2023 we have inflation stay with us for some years. Central banks give out warnings in this direction now as well, having negated the problem for far too long (their own statistics ECB on long-term forecasts of inflation).

Besides the ample economic advice (IMF), depending on which theory of money and the economy you adhere to, political theory allows a refreshing perspective on these economic facts and trajectories. (1) From an international strategic perspective, countries that have to renegotiate a lot of their debt or take new credits to finance imported food, energy or transport will run into insolvency rather quickly. Self-sufficiency becomes an economic asset not only a geo-strategic one. Turn around globalisation is a side-effect.

(2) Countries eager to build new public infrastructure, irrespective of concerns for bio-diversity, might reschedule or abandon huge projects, thereby reducing their CO2 footprint. This reduces the official counting of GDP, but has beneficial effects to save the planet in the medium term.

(3) Individuals and households will have to reconsider their consumption patterns: more expenditure for food, less for energy and/or transport. Behavioural changes might be induced by inflation. Less of some form of consumption, guided by inflation, will induce reductions in CO2 most likely as well.

So far this is only applied economic theory as in any textbook. A more challenging political economy question is to ask: can we come to like inflation? Can we change our preference set (ECB growth dogma) for economic variables? Southern countries in Europe seem to like inflation more than the North. Does this depend on historical experiences or is it cultural or personality trait? There is again a huge money transfer due to inflation within the Eurozone. The less indebted countries pay with loss of their purchasing power of their savings and indirectly pay for the highly indebted countries mainly in the South. European and international solidarity will be put to a tough test.

As governments fear of being voted out of power they tend to soften the price signals from markets. Again, it is cultural more than economic to what extent people are willing to accept state interference in economic affairs even of households need for food. From an ecological point of view inflation could be our friend due to the potential to induce behavioural changes. However, more expensive bio-products seem to get crowded out due to further price rises and many even middle-income households seem to return to cheaper non-bio food in many countries. The distributive effects of inflation are a major issue here. Same rationale seems to apply to transport. If you can no longer afford CO2 saving transport by train, since it has become overly expensive more people are likely to take a heavily polluting low-cost flight to your holiday location.

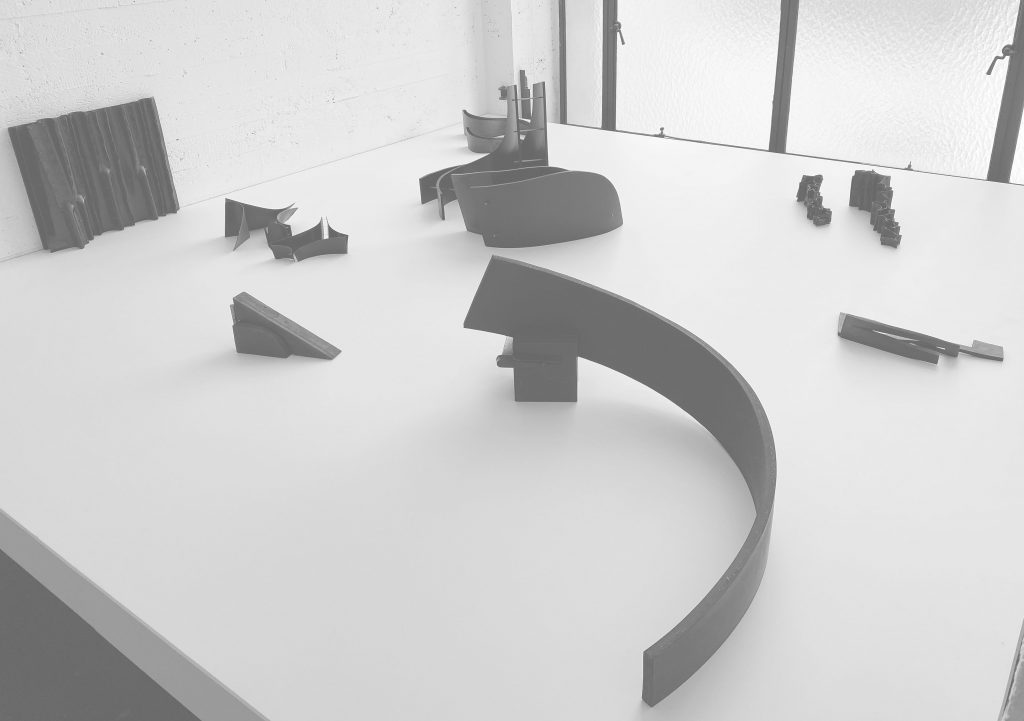

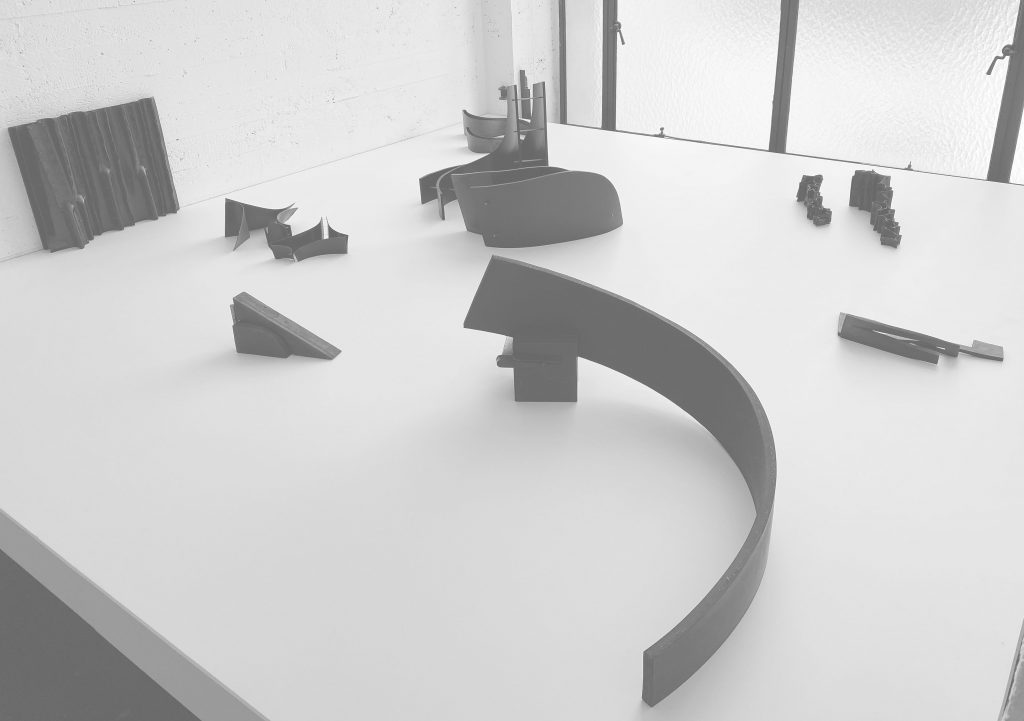

Hence, from a political economy perspective liking inflation might well turn out to be a rich, white man’s perspective on the economy as the global South is likely to suffer most having no resources left to invest in energy and CO2 -saving in general. Price signals may induce behavioural changes for the better of us all. However, the story it is not only about allocation of resources, but also about distribution. There we should embrace a renewal of trade union strength to correct imbalances in the distribution of earnings as the basis for consumption and investment of households as well. (Image: Tapta, at Wiels Gallery in Brussels, 2023-6, mostly untitled work, one with title: on the edge of time).