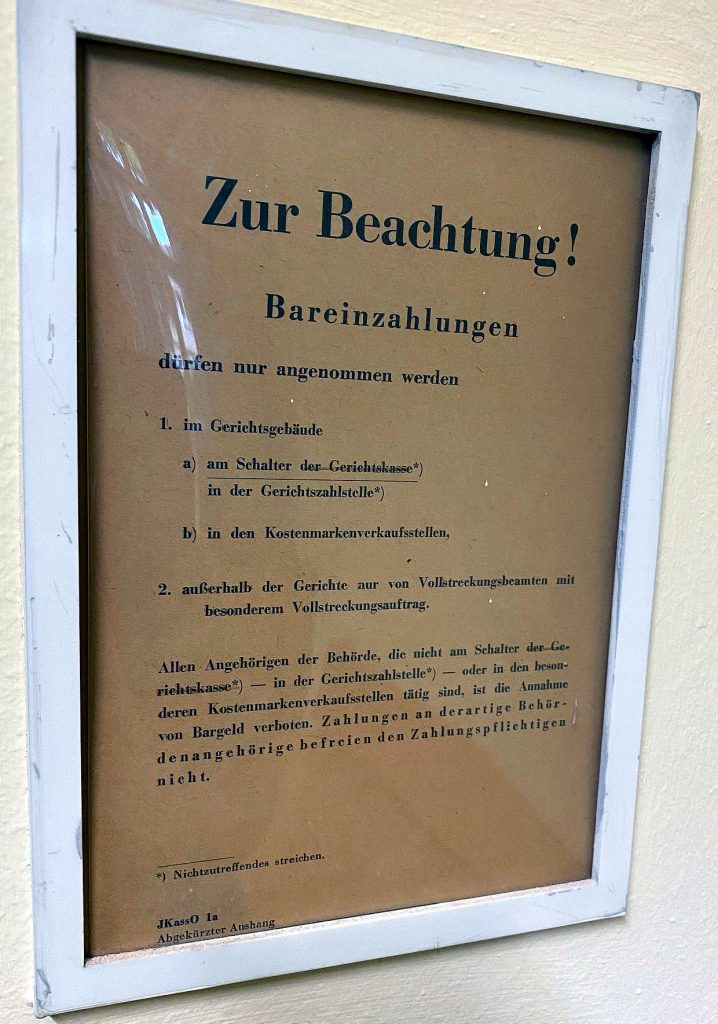

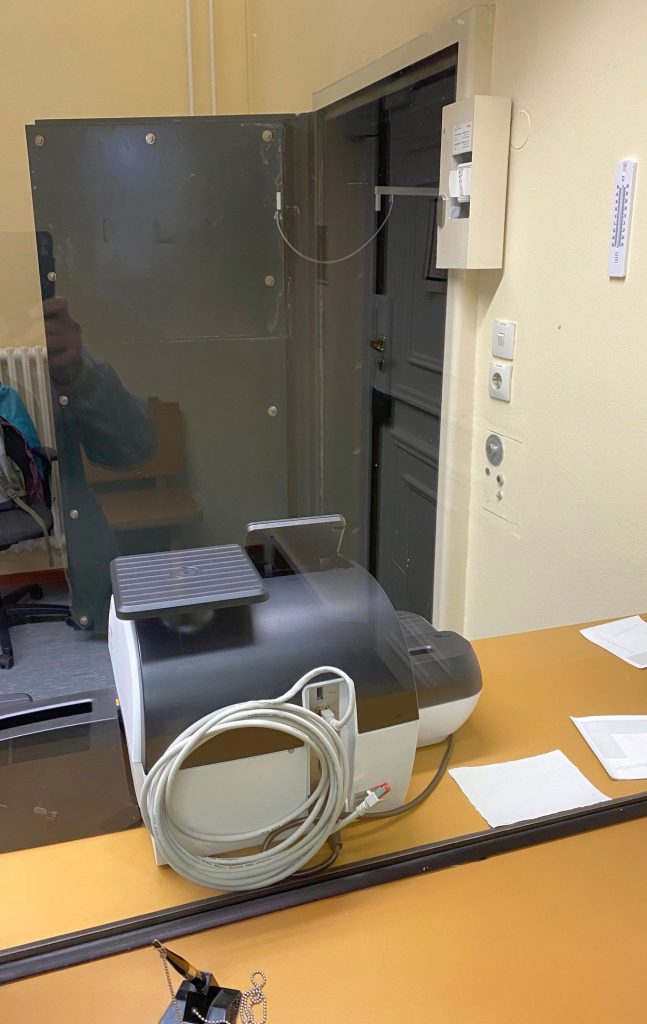

In den deutschen Amtsstuben geht es Ende 2023 oft noch erschreckend analog zu. Für einen Grundbuchauszug, beispielsweise, hatte ich das außerordentliche Vergnügen das Grundbuchamt am Amtsgericht in Berlin Ringstraße aufzusuchen. Sonst nimmt man sich ja nicht die Zeit, solche Sehenswürdigkeiten von innen zu besuchen. Die Überraschungen waren vielfältiger Art. 3 Personen Wachpersonal und Metalldetektor, wie bei der Flugabfertigung. Für den Auszug aus dem Grundbuch ist selbstverständlich eine Gebühr fällig, die nur bar entrichtet werden kann. Auf zur Zahlstelle, immerhin auf dem gleichen Flur. Die nächste Amtsstube hat zwar noch einen richtig historischen Tresor, aber die Erfassung der Zahlung läuft wohl noch auf alten Geräten. Vielleicht per relativ unsicherem WLAN verbunden. Das LAN-Kabel ist jedoch schon mitgeliefert, das dann irgendwann einmal eine sicherere Netzanbindung ermöglichen wird.

Über einen Dienstleister lässt sich der Verwaltungsakt auch online erledigen unter Herausgabe der Kreditkartendaten und sonstiger Daten (Cookies) samt Unterschrift per Maus (!). Das ganze für die doppelte Verwaltungsgebühr. Dank des 49 € Tickets wollte ich mir diesen Spaß jedoch live gönnen. Wahrscheinlich werde ich das nochmals mit den Enkelkindern so als lebendigen Museumsbesuch nachvollziehen. Wer weiß, wie lange das noch möglich sein wird. Das Personal trägt es mit Fassung und dem nötigen Humor.

Bisher kannte ich die Diskussion über die Digitalisierung der Verwaltungen mehr aus wissenschaftlichen und technischen Diskursen. Jetzt kann ich so richtig in das Jammern darüber einstimmen. Produktivitätsfortschritte lassen sich hier in ungeahntem Maße erzielen. Einer geht noch: Was ist das längste Wort in dem Amtsvorgang und wie viele Buchstaben hat es?

Gerichtskassenstemplerabdruck (auf der Quittung).

Aging Challenge

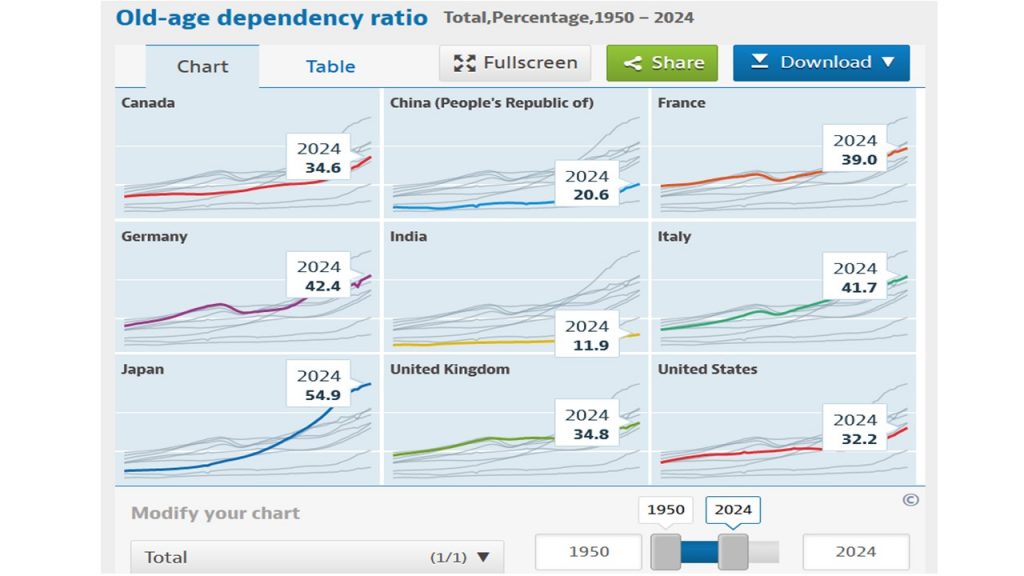

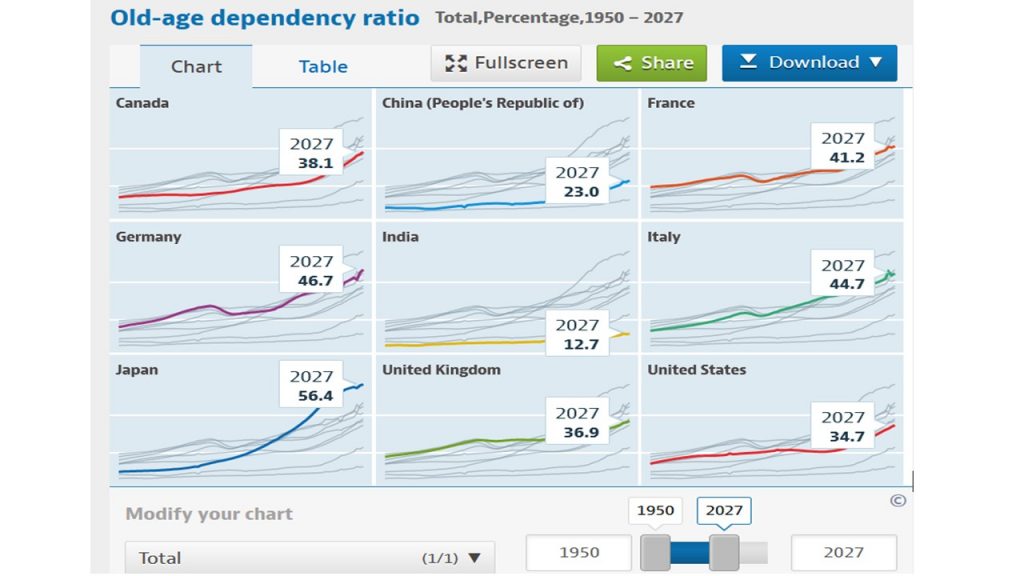

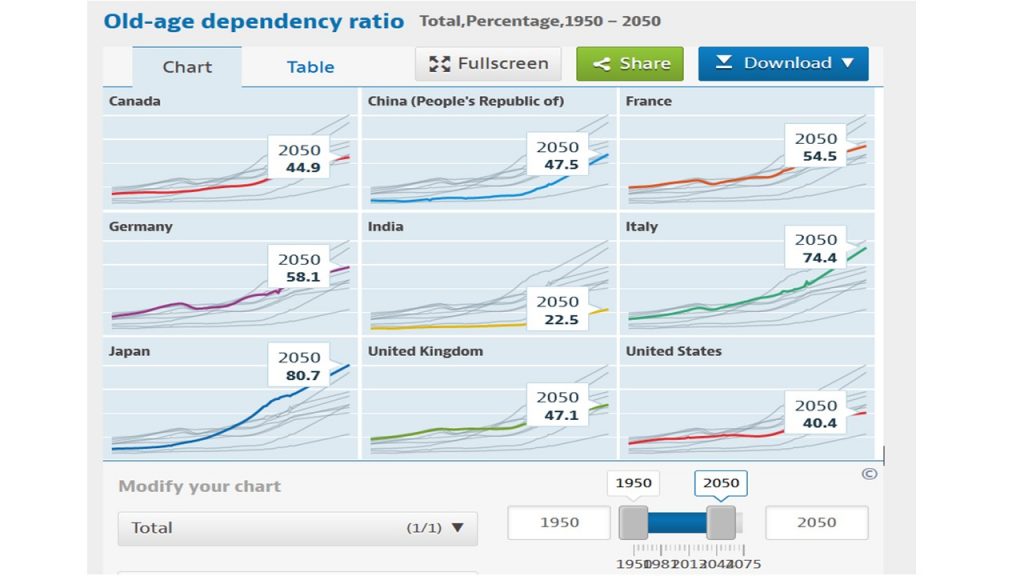

Several countries face an aging challenge now and in the near future. The OECD provides some basic data, figures and projections. All data to calculate the aging challenge are more subject to change than they used to. The Covid-19 rise in mortality rates has implications as the number of premature deaths of the elderly (65+) has risen even in the economically advanced countries. The so-called old-age dependency ratio is a widely used indicator to assess the charge or pressure on the working-age population (20 to 64) to finance those in retirement (65+). demographic ratio is defined as the number of individuals aged 65 and over per 100 people of working age defined as those at ages.

Major factors that have an impact on the ratio are mortality and fertility rates as well as migration, but also participation rates in employment for those younger than 20 or older than 65 years of age. Seminal shifts in participation of women in the labour force contribute also to reduce the old-age dependency ratio. An influx of about 1 million of refugees who have immediately a work permit like Ukrainians in Germany have a substantial impact as well. Life expectancy is expected to rise again after the years of reduction due to Covid-19. In 2024 and 2027 these ratios do not move too much. Extending the time horizon to 2050, when people born in 1985 would start to retire shows more reason for concern. Whereas in 2024 France, Germany and Italy are still fairly close to each other (2.4 percentage points), the gap starts to widen as of 2027 (5.5 percentage points). In 2050 Italy is projected to have an old-age dependency ratio of 74.4%, about 20 percentage points higher than France.

Okay, in the long-run we are all dead, says an economist joke, but changes to increase fertility or allowing more migrants in are not in sight for Italy. Therefore, the urge to react is increasing there. Younger generations might not be able or willing to foot the bill of high pension expenditure in Italy. Compared to Italy or even Japan the pressure on France is much less pressing, contrary to the national government’s opinion and policy initiatives to increase retirement age without parliamentary majority.

Source for projections and figures: OECD (2023), Old-age dependency ratio (indicator). doi: 10.1787/e0255c98-en (Accessed on 04 October 2023).

Nations Fail

Ever since Adam Smith wrote on the “Wealth of Nations” the topic concerns social scientists. The discourse around the wealth of nations has become even more fundamental these days. Beyond wealth calculated in economic terms we are convinced to add well-being of the population as well as the state of the environment into the accounting procedures like national accounts. But wait a second. Similar to the term wealth we have to widen our perspective in what is considered to be a nation. Shifting borders through wars (Russia aggression on Ukraine) or separatist tendencies of regions, (re-)unification of Germany or Korea (eventually) show that the nation is a concept in flux. Considering migrants from former colonies still as having residential rights in the colonising country shows, there is more to nations than a one size fits all nation concept.

Daron Acemoglu and James A. Robinson had published the book on “Why nations fail. The origins of power, prosperity and poverty” already in 2012. On the 3rd of October Germany celebrates its re-unification only because the Russian dominated German Democratic Republic (and the other Eastern European satellite states under Russian control) can be considered as a failed state. These Russian dominated states crushed private initiatives and build corrupt systems where party allegiance and hierarchical structures were overemphasised. Following Acemoglu and Robinson (chapter 10) the lack of diffusion of prosperity is likely to be the root cause. Even similar to the French revolution, which brought about tough measures of redistribution, the external threats to the post-revolution France demanded subscription of masses into armies to defend the young republic against aristocratic rulers in the surroundings. If monarchy in France is a failed state, the post-revolution France survives due to high identification with the republican idea. The Soviet dominated Ukraine is a failed state, but the Ukraine of today resists due to its willingness to defend its own republican ideals. To get virtuous circles of development started, inclusiveness across the board is necessary. Leave nobody behind, seems to be a shortcut summary. It is much easier said than done. Loosing younger generations in the sense that they no longer subscribe or feel part of an inclusive wealth of the nation is a highly dangerous path. Failed states have a history in failed inclusive social and economic practices. Democracies are at risks just as much as authoritarian nations. However, democracies have better institutional settings to address the lack of inclusion and in multiple ways.

When I celebrate the 3rd of October in the Federal Republic of Germany I celebrate (1) the accomplished failure of the GDR, its undemocratically elected elites, corrupt institutions and the failure of the thousands of willing collaborators of the Russia-backed regime; (2) the peaceful resistance movement, (3) the relatively short-lived humanitarian focus of the Russian leadership at the time to not send in the tanks and (4) the willingness of the FRG to support 20 million new citizens for many years to come (5) the allies of the FRG to accept the potential security threat of a strengthened Federal Republic of Germany, which might entail a shift in the balance of power in Europe.

And yet, even in 2023 we pose questions on what is the concept of failure, when authoritarian regime can still survive for sooo long and some still accomplish extensions. We keep questioning the sense of the term “nation” in modern times and across the globe. Too many wars are still fought in the name of a “nation” even if only a handful of military-supported leaders and single autocrats try to impose wars in the name of some rather vague or plainly mistaken claim of nationhood.

On the 3rd of October we celebrate that “nations can fail” opening a path into a more prosperous and inclusive society. Some nations fail, just because they were no nation in the first place. The GDR was such an artefact of international compromise as part of the overall “balance of power” and the Cold War. The result of this process gives so much hope to other divided nations (Korea) or nations under authoritarian oppressive rule.

Energy Food

For more than a decade now researchers have shown the link between energy prices and food prices. At first sight this might seem surprising. In traditional or romantic associations with growing food, there is no link between the cost of energy and food production. Growing crops in your garden does not need more than sunlight, soil and water. Yes, that was long ago. Industrial production of food is heavily relying on energy to heat, feed and water plants or animals. Additionally, the supply chains have become far more distant, which increases the CO2 footprint even further. Therefore, it is no longer surprising that a great number of econometric studies confirm the close link of energy prices and subsequent pressure on food prices. This is not restricted to Europe, but has reached global contamination.

Enjoying seasonal local food is a double catch solution. You grow according to local weather conditions and use traditional conservation methods, if the crop is exceeding your demand at that time. Providing heating for animals to increase productivity or quality of products appears to be one of the most wasteful ways to further increase the spiralling up of energy and food prices.

In agricultural science there is a lot of research into the “energy intake” of animals to better grow or produce more milk etc. This is the expensive intermediary step using energy to produce energy intake for animals rather than humans. It is surprising that we take so many years to address these well-known linkages that have turned to serious problems after Russia’s war on Ukraine. Agriculture and farmers can be part of the solution rather than a problem themselves, if the link of energy consumption and food prices is taken seriously.

10000

In France 100.000 is associated with Monsieur 100.000 Volt Gilbert Bécaud due to his dynamic singing and performance style. Since August 2023 we now have an additional association with the number 10.000. Ten thousand m3 was the size of stones that came down from the mountains near the popular skiing resorts in the French Alps (Le Monde Link+video). To visualize the amount, a back of the envelope calculation with a standard container size of 25 m3 returns 400 loads of lorries to be removed from hard to access landscapes. Count this into the costs of running ski resorts.

A study in the scientific journal “Nature Climate Change” in 2023 highlighted the increasing risks to European skiing sites. Same holds for the Alpes in Switzerland. Some areas relying on water resources to create artifical snow do so in less and less safe areas. Costs accrue to communities who benefit only indirectly from the skiing hype, celebrating 100 years of Olympic skiing next year. After all it is big business to sell or lend equipment, provide hotels and meals for all those sports women and men.

The so-called collateral damage is probably even worse. Interrupted railways, bridges, motorways and traffic in general becomes a severe disruption for quite some time adding to the total costs of having fun in winter. Is it worth it? A tricky question to ask in a referendum. We shall have to revise our past decisions to expand skiing resorts in light of the new evidence of higher risks and costs involved. A book on 10.000 years of history of glaciers is full of side-effects of glaciers melting away, which cause instability to valleys on the sidelines. In the most recent break-up of rocks it is actually more the access to the skiing resorts that was blocked, but this demonstrates to all: passing this area now, is not without serious side-effects.

Too big

Too big to fail. We all thought that after the financial crisis some fifteen years ago, we would not deal with the same kind of problems again. The banking sector in Switzerland has proven us wrong. One of the 2 big banks Credit Suisse in Switzerland was about to default and asked for 170 billion state guarantee middle of March 2023. Only after a forced merger with the other big bank UBS (which was rescued in 2008 already) and the huge state guarantee the solvency of the even bigger bank was re-established. Tax payers were expected to foot the bill. Less than 6 months later the Finance Minister Karin Keller-Sutter announced that there is no longer a risk for tax payers to pay for the mismanagement of the bankers involved. This is a relief for the political system which is going to the polls next year.

Many unresolved questions remain. Financial market supervision is faulty to say the least. Banking left to bankers as controllers is risky. Apparently fines do not work only prohibition to exercise similar functions (internationally) again is likely to be effective (NZZ 2023-8-9 S.19). Other remedies lie in a complete overhaul of the governance system of banks and beyond. Supervisory boards should in theory be able to assess the risks incurred by the management board. Failure to do so has no consequences for them either. Representatives of the employees in the board is likely to introduce more longer term concerns into decision-making. Saving jobs is a valuable goal not necessarily in the interest of investment bankers. Capitalism is at high risk of survival and with it our democratic systems. It was not a bank in Niger that got into trouble, but at a major European financial center. Too big to fail in a tiny country still sends shivers throughout Europe. And the other big bank is growing even bigger now, probably un-savable now. If I had a bucket of Swiss Franks, I would rather sell them.

Anger

It feels like we live in the “age of anger”. Anger was a predominate feeling in the “French yellow vest movement” spurred by sharp increases in petrol prices. In Germany the notion of “Wutbürger” had a short career to express anger of citizens against, against whatever could arise anger. There are plenty of issues of course that will cause arousal in public politics. The more a government enacts change, be it necessary or not, the more it is to arouse its citizens. Parliamentary democracy is thought to solve this through majority voting of the equally represented in parliament. Minority rights have been installed to safeguard the majority to become too overwhelming, but any close decisions on hotly debated topics are likely to cause substantial anger within a society.

This is far from being an issue only in Western democracies. Pankaj Mishra claims, this is a world-wide phenomenon and history provides ample examples for it. In his book on “The age of anger” he challenges the predominantly Western political theory, deriving from an opposition of Voltaire’s and Rousseau’s political thought to hold the individualisation and globalisation of an economic model, traditional capitalism, responsible for the rise of anger across the globe.

This critique of capitalism is now translated into French. Several movements of anger in France probably find some unifying roots of seemingly unrelated outbreak of anger, violence and subsequent repression. Old arguments of critics of capitalism stand up again. The challenge to democracy comes from the extreme right even more than from the extreme left. Re-imagining capitalism is needed more than ever to safe the survival of democracy. Participative democracy like in Bürgerräte in Germany or deliberative democracy practiced by President Macron in France are an important part to stimulate involvement of more people in the preparation of decision-making. Not perfect as procedures, but small steps ahead to confront and address anger of the citizens and people at large.

Work Stress

The empirical evidence on life stress is relatively clear cut. Based on the animal model, life stress causes multiple metabolic disorders among them “insulin resistance, glucose and lipid homeostasis, as well as ageing processes such as cellular senescence and telomere length shortening” (Kivimäki et al. 2023). Besides sleeping we spend most of our life in work-related contexts. Stressful commuting to work and stress at work create a rather unhealthy lifestyle. More stressful working lifes have very likely contributed to currently increased risks of obesity around the globe. Unhealthy nutrition adds to risks just as too little exercise or walking. Time to act for the benefit of all of us. It is not correct to put the blame on individuals, if we know that work and life styles jointly contribute. Urban planning can do a lot to contribute to insulin resistance of inhabitants through more walking or cycling paths for all not only in the wealthier suburbs. The more stressed winner of the daily race might come last in the longer run.

Geister

“ Herr, die Not ist groß!/ Die ich rief, die Geister/ werd ich nun nicht los.“ Dieses Zitat aus dem Zauberlehrling von Goethe aus dem Jahr 1797 könnte im Juli 2023 von Putin ausgerufen worden sein. Als der von ihm geförderte und üppig finanzierte Chef der Wagner-Armee Prigoschin plötzlich auf Moskau losmarschierte. So sehen das viele Analysten zu Beginn des scheinbaren Angriffs auf Moskau eigener Söldnertruppen. Frei nach Goethe fragen wir uns also: Wer und Wo ist der Meister? Wer ist hier der Zauberlehrling? Aber schon Goethe hat seine Ballade rasch und ohne Überraschung aufgelöst. „In die Ecke, Besen, Besen! Seids gewesen. Denn als Geister ruft euch nur zu seinem Zwecke, erst hervor der alte Meister.“ So entpuppt sich am Ende Putin wohl als der Meister und Progoschin „nur“ als sein Zauberlehrling.

Das ist nicht die herrschende Meinung der Redakteure und Editorialisten (Süddeutsche, LeMonde). Literatur der Romantik sollte besser aus der Tagespolitik herausgehalten werden. Weit gefehlt. Sie weitet den Blick auf Herrschende, meist Autokraten, und ihre tragischen Lebensverläufe.

Jetzt mal eine ernsthafte Vision(?) eines Politikberaters. Da die Mission von Prigoschin mit Unterstützung oder angeordnet von Putin in Butcha als abgeschlossen galt, und das Staatsheer diese Aufgabe übernommen hatte, wäre Prigoschin arbeitslos geworden. Den treuen Chefkoch Prigoschin aus St. Petersburger Zeiten, der Putin in seinen Restaurants schon hätte vergiften können, hat seinem Meister vorgeschlagen, Putins faktischen Schutz vor einem Anschlag oder einer militärischen Einsatzgruppe zu testen.

Militärisch gesprochen, läuft das entweder unter einer „false flag attack“, eines mit russischer Flagge getarnten Angriffs, oder einer „white flag attack“, dem Vorspiegeln einer geschützten friedlichen Mission (vgl. trojanisches Pferd).

Aus der Sprache der Börsianer kennen wir ebenfalls die „weiße Ritter“ Attacken. Dabei versucht ein anderes Unternehmen, eine InvestorIn oder eine im Hintergrund agierende Person (Progoschin), eine feindliche Übernahme eines Unternehmens zu verhindern. Dabei sind Mehrheitsbeteiligungen am Zielunternehmen oder Fusionsangebote die gewollte Lösung und Abwendung der feindlichen Übernahme.

Im Internetzeitalter kennen wir die bezahlten Hacker, die eine Webseite eines Unternehmens oder Behörde auf Schwachstellen testen und damit Datenschutz, Erpressung und Ausfälle vermeiden helfen.

Klingt alles kompliziert, ist es aber nicht. Es ist einfach Teil des modernen Arsenals von Strategen à la Clausewitz. Schachspielen mit echten Söldnern ist grausam und kostet echte Menschenleben für den Machterhalt. Der militärische Probealarm wurde getestet und der Schutz um Putin, den Meister mit seinem Zauberbesen kann verbessert werden. Sein Zauberlehrling Prigorschin ist wohl vielleicht sogar vom Springer (Schachfigur) in einen Turm eingetauscht worden. Vielleicht ist er aber schon längst die Dame an der Seite des Königs oder eben einer der Geister im Umfeld von Putin.

Political theory and inflation

A political theory in the area political economy is prone to be labelled as classical, neo-classical, Keynesian, Neo- or Post-Keynesian or heterodox economics. This is a university level course in the history of economic ideas, if you like this. Let’s try something creative here. We have unprecedented levels of inflation currently in Europe and many other parts of the world. Reasons for this are higher prices for energy, transportation and food. Anything else you need for life? You must be an artist or a priest, a bit off the normal, it seems to many economists. Add to this that, we want to foster strategic autonomy in Europe rather than anything from China that is cheaper and more polluting. In 2023 we have inflation stay with us for some years. Central banks give out warnings in this direction now as well, having negated the problem for far too long (their own statistics ECB on long-term forecasts of inflation).

Besides the ample economic advice (IMF), depending on which theory of money and the economy you adhere to, political theory allows a refreshing perspective on these economic facts and trajectories. (1) From an international strategic perspective, countries that have to renegotiate a lot of their debt or take new credits to finance imported food, energy or transport will run into insolvency rather quickly. Self-sufficiency becomes an economic asset not only a geo-strategic one. Turn around globalisation is a side-effect.

(2) Countries eager to build new public infrastructure, irrespective of concerns for bio-diversity, might reschedule or abandon huge projects, thereby reducing their CO2 footprint. This reduces the official counting of GDP, but has beneficial effects to save the planet in the medium term.

(3) Individuals and households will have to reconsider their consumption patterns: more expenditure for food, less for energy and/or transport. Behavioural changes might be induced by inflation. Less of some form of consumption, guided by inflation, will induce reductions in CO2 most likely as well.

So far this is only applied economic theory as in any textbook. A more challenging political economy question is to ask: can we come to like inflation? Can we change our preference set (ECB growth dogma) for economic variables? Southern countries in Europe seem to like inflation more than the North. Does this depend on historical experiences or is it cultural or personality trait? There is again a huge money transfer due to inflation within the Eurozone. The less indebted countries pay with loss of their purchasing power of their savings and indirectly pay for the highly indebted countries mainly in the South. European and international solidarity will be put to a tough test.

As governments fear of being voted out of power they tend to soften the price signals from markets. Again, it is cultural more than economic to what extent people are willing to accept state interference in economic affairs even of households need for food. From an ecological point of view inflation could be our friend due to the potential to induce behavioural changes. However, more expensive bio-products seem to get crowded out due to further price rises and many even middle-income households seem to return to cheaper non-bio food in many countries. The distributive effects of inflation are a major issue here. Same rationale seems to apply to transport. If you can no longer afford CO2 saving transport by train, since it has become overly expensive more people are likely to take a heavily polluting low-cost flight to your holiday location.

Hence, from a political economy perspective liking inflation might well turn out to be a rich, white man’s perspective on the economy as the global South is likely to suffer most having no resources left to invest in energy and CO2 -saving in general. Price signals may induce behavioural changes for the better of us all. However, the story it is not only about allocation of resources, but also about distribution. There we should embrace a renewal of trade union strength to correct imbalances in the distribution of earnings as the basis for consumption and investment of households as well. (Image: Tapta, at Wiels Gallery in Brussels, 2023-6, mostly untitled work, one with title: on the edge of time).

Ground Water

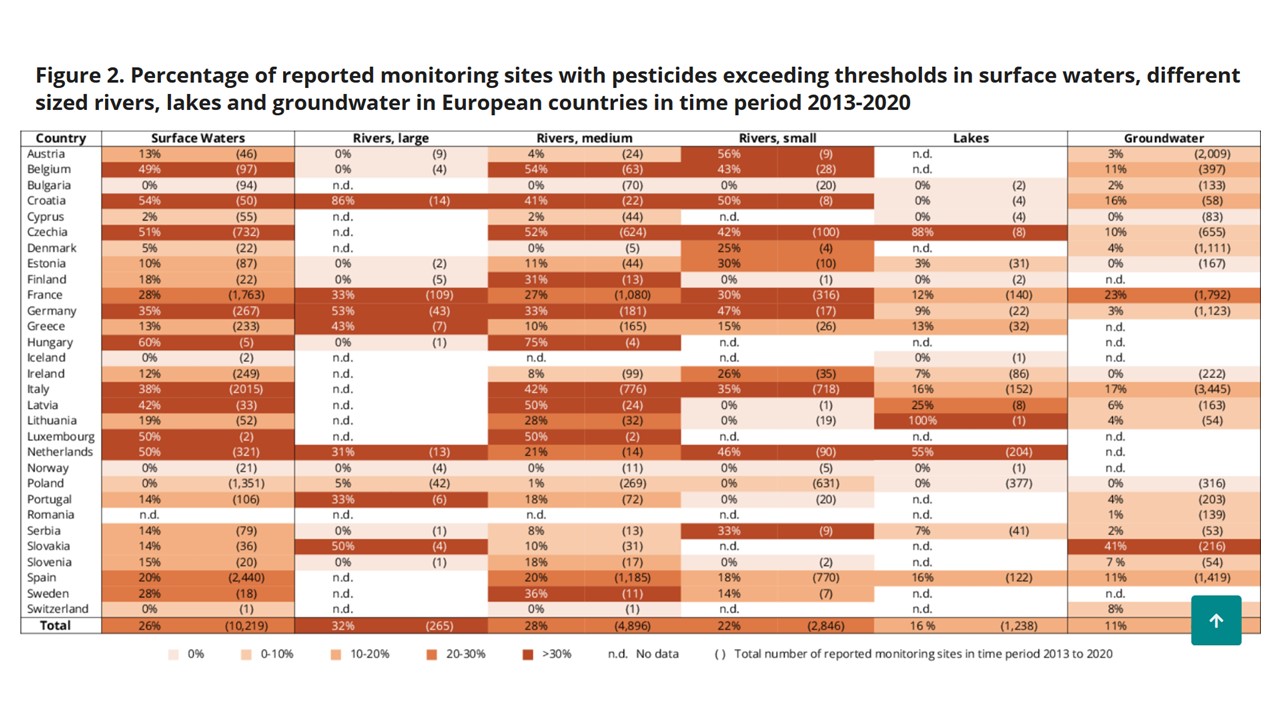

The European Environment Agency collects annual data on pesticides in the ground water. The water most of us use in some form or drink. This used to be possible without too much thinking a generation or two ago. We now learn that this might be more and more dangerous, particularly in areas, where less rainfall and prolonged periods of draughts most likely increase concentrations of pesticides even in our tap water. Drinking this, raises more concerns. We know that in big cities and nearby of hospitals water quality is worse due to the concentration of particles from chemicals applied to increase contrasts in medical imaging. Pesticides are mainly used in agriculture, road and rail maintenance, but also households apply them for simplicity.

Snails (escargots) might invade your garden and even your home at times. However, it is just a little bit of exercise to “relocate” them in a decent place other than your home. Prepare a race for several ones and bet on who is going to win, but please refrain from the use of more pesticides. Several species of them are consumed and, depending on your taste, considered a delicious part of a meal (for example in Bourgogne, France). It should be easy to agree to stop the heavy use of pesticides across Europe and beyond. We shall have to protect the salads we grow differently. Human intelligence is able to allow other solutions than just killing as efficiently as possible ,at the same time, endangering our own species. (Comparable data EEA below).

Gaslager

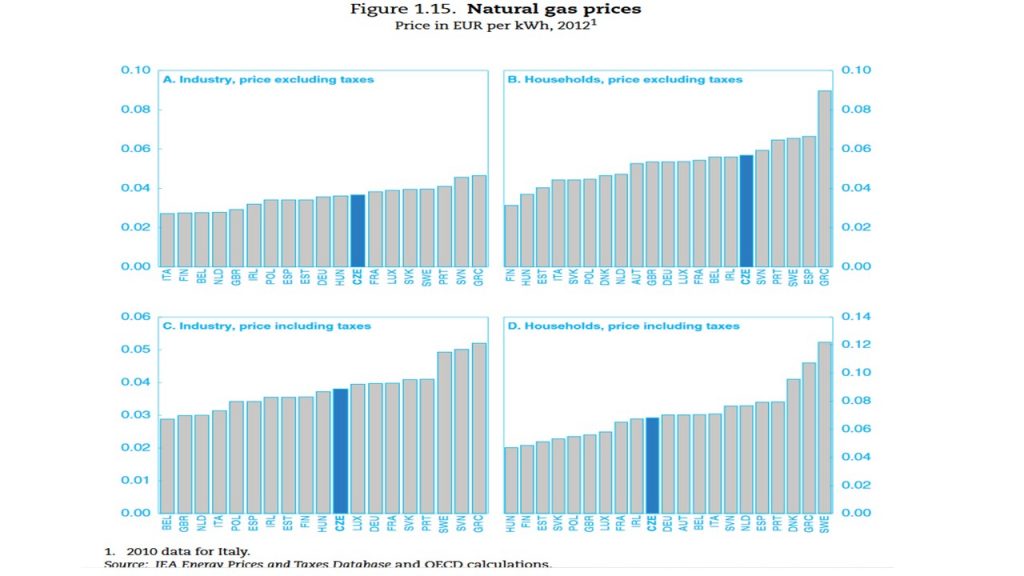

Der Gaspreis (TTF in Amsterdam) ist zum Ende Mai 2023 auf ein Tiefstwert von 23,50 € pro Megawattstunde zur Auslieferung einen Monat später gefallen. Der Unterschied zum Höchstpreis von ca 300 € übersteigt die Erwartungen der meisten Kunden. Das sind die Spekulanten und Zwischenhändler. Der Preis für die Endverbraucher bewegt sich weniger. Kartellbehörden in Europa müssen wachsam bleiben damit die Endverbraucher nicht zusätzlich zur Kasse gebeten werden. Gaslager für zivile und militärische Zwecke wurden vom Bund billig vor Jahrzehnten verkauft (Privatisiert) und sind jetzt wieder zu einer unverzichtbaren Infrastruktur geworden. Der Kapitalismus fällt immer wieder in seine eigenen Fallen durch exzessive Volatilität. Öffentliche Infrastruktur braucht langen Atem und sollte dazu dienen, die übertriebene Spekulation mit der zeit Grundversorgung der Bevölkerung zu vermeiden. Gaslager, Öllager, Wasserspeicher und Stromspeicher bei zentraler Stromerzeugung gehören dazu. Dezentrale Lösungen verstärken die Resilienz und Souveränität weiter. Europäische Solidarität hilft enorm, diese Herausforderungen zu meistern. Wichtig ist nicht nur der Einkaufpreis, sondern der Preis vor und nach Steuern sowie Unterschiede zwischen Industrie und Haushalten (Beispieldaten OECD 2014 für Jahr 2012, IEA Gas Market Report various years). Die ökologischen Sauereien rund um die Shale-gas Förderung in den USA haben uns wohl geholfen, besser durch die künstliche Verknappung von Gas für Europa durchzukommen durch die Erhöhung der gesamten Fördermenge. Ein weiteres “worst case szenario” zur Bekämpfung von Preisschocks. (Paper Link)

Put People First

Put people first is a natural claim of human beings. We tend to abstract from the fact that we implicitly rely on a sufficient biodiversity for our survival. Therefore, the natural claim to put people first has many preconditions itself and severe implications. The most obvious implication is related to our world of production and consumption. We need to build an economy that serves its people rather than one that uses up human resources and discards people to an inferior rank of importance. Externalising health and safety at work to save money in the process of production will only cost society much more later on. This needs to be part of the balance sheet of companies not only “national accounts” or relegated to some health statistics hardly known to the public.

Put people first in consumption, has come to our attention recently. With energy prices rising due to Russia’s war on Ukraine territory we have learned that energy prices may be grossly distorted. Firms’ versus consumers’ energy consumption became a thorny issue. Even legislation, like in Germany, that put people’s energy consumption before companies’ consumption of energy became subject for debate.

Same issue with artificial intelligence. Let’s put people first here as well. Discriminating use of language or biased conclusions due to wrong data input to train AI is not acceptable as excuse. AI may serve humans in their work or leisure, improve production lines through error detection or early onset of disease, but it cannot replace the human verification of a just or otherwise justified human intervention. Humans are not perfect, never will be either. This is a tough rule to teach the algorithms that guide AI. Put people first has a strong interpersonal or solidarity element enshrined in it. This is what matters, now, in the medium term as well as the long run.

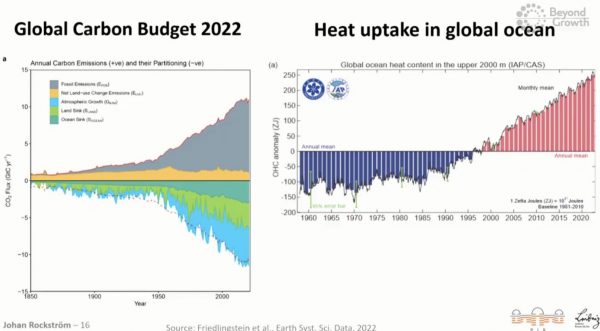

Beyond growth

We have reached the bio-physical limits to economic growth much earlier than most people and experts expected. The “Beyond growth conference” at the European Parliament 15.-17.5.2023 is quite unanimous in this verdict of collective failure. Some advocate “degrowth” in various forms. Maybe the framing of how to address the vital topic of how to set objectives for a post-growth economy needs an even broader perspective. It is a global issue, but the industrial growth societies around the globe will have to work together to find and implement solutions. The worldwide conference COP-XY are hardly delivering on the issue. At best they satisfy the ego of political leaders to address important issues providing nice images from nice places in the world (Paris agreement) to advance their own political campaigns.

From an economist’s view rather than solving a very complex issue with uncertain outcome, it is more instructive to, for example, start to produce the same economic and social well-being by using much less natural resources above all climate-toxic elements (Carbon-dioxide CO2, Chlorofluorocarbons CFC, or methane). These are simple first steps with a rather immediate effect. After the recent crises we have learned to safe resources (heating) and reduce mobility, just continuing on this trajectory is feasible. Vastly excessive forms of consumption need to be capped through targeted taxes that allow redistribution or investment in reduction of pollution. It isn’t hard to do, or “It’s easy, if you try“, we might sing.

De-risking

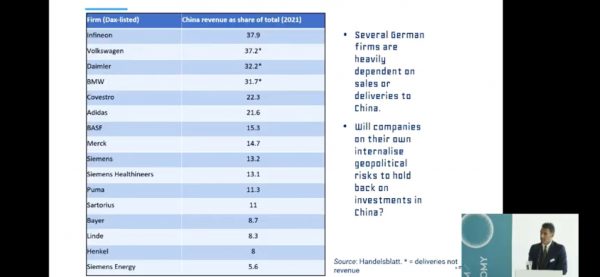

Risks are all around us. Risk is the spice of life. True, but this might be an elitist concept of life or business. Survival of the fittest or the best equipped to take risks might be the consequence. After the 3 crises, financial, covid, energy, we have a new impetus to thrive for de-risking. Certainly, concerning our health, we are aware that prevention is key to fight a pandemic. In order to stem an energy crisis, most countries start to rethink their energy mix and achieving more energy autonomy is a major step to shield against risks of delayed delivery or commerce with belligerent states like Russia. De-risking is key in supply chains for industries (automotive production, microprocessors) as well as service providers (cloud services, care givers) just as well. Mariana Mazzucato (UC London) urges us to develop a new narrative to accompany the transformation of our production and service provision models. Mazzucato advocates to learn from lessons from the ground of how to proceed in the best way. Copenhagen is a good starting point to observe how a metropolitan city manages the greening and decarbonisation of a city. It is important to not only target single policies but the coherence of several policies and approaches. In my view de-risking means for Germany and the EU to shield energy systems from foreign, malignant interference. Only local production of energy and nearby consumption of it will ensure the de-risking of energy provision and consumption. Let us start with massive investments in rooftop solar or small wind turbines. Nobody complained about millions of ugly television antenna all around us. Solar cells on balconies contribute to a basic local electricity supply, difficult to target millions of solar cells instead of a single huge and horrifically dangerous nuclear power plant. At the same time ,we reduce dependency on monopoly or oligopoly structures that develop their own agenda (Too big to fail, remember those?). I prefer the reverse statement. Because they are so big, they are doomed to fail and, therefore, fail us sooner or later. The Forum New Economy offered an open and accessible platform for exchange of ideas. That’s a good starting point to address de-risking. Reducing Risk is in the subtitle of Rebecca Henderson’s Chapter 3 on “Reimagining Capitalism” (short Review), but I would like to add the business case for household production of energy for de-risking supply failure and exploitation of consumers through excessive profit margins as a prosumer business case.

Crises

Crises, yes crises, we have seen a few in recent years. After the first financial crisis, 2009, the COVID-19 crisis and now the energy crisis, , they all have cost us respectively 1.6%, 2.5% and lately a whopping 7.8% of GDP loss according to Tom Krebs (Uni Mannheim and FNE) in his assessment of lessons from these crises. Also Philip Lane (ECB) showed the lower GDP growth rates due to the crises.

We lost out on the wealth of our nations and face mounting difficulties for the distribution of this wealth. As firms cashed in on profit margins lately, workers risk even more to fall behind significantly. At the same time, it is high time to prepare for the next winter season now, to ensure the same risks as the dependency on energy resources from outside Europe, especially Russia, can be maintained. The conference of the Forum New Economy from the 8th of May 2023 discussed several ways forward to learn our lessons from these crises. Strategic independence needs to be properly defined for Europe as a whole, not just in each individual state. Implementation has to be rapid as well. Geopolitical challenges will not wait for us to finish discussions. Germany and minister Robert Habeck has received some acclaim from the economists for a fast and rather successful reaction to safe us from an energy crisis last winter. Massive increases in renewables (+20% solar energy) has helped a lot to ensure sufficent energy supply when France suffered heavy reductions from its nuclear energy power plants. “Let the sun shine … in”, I would sing. However, we have to think even further ahead build our resilience based on improved energy efficiency and may rethink the risks and vulnerabilities of our economic model of production and consumption. Diversifying imports from Russia with imports from other countries and other (green) forms energy is part of the solution. A heavy reliance on China as buyer of our products is good for trade balance, but some sectors (automotive) are nowadays critically dependent on selling in China. Some of our partners are very anxious about this new dependency on Asia for our economic growth model (see figure below from conference). Market based economies suffer more openly from huge economic swings than more secret-based autocratic economies. Our state agencies have to keep that in mind and state intervention seems to become more likely options in future as we have already witnessed in the past crises. We had to rely on running higher state deficits to cover the losses incurred from the crises. The EU, the larger Europe in combination with the transatlantic and pacific alliances has a lot of resources to address these strategic interdependencies. Being prepared, in strategic thinking and potential implementation procedures is a major part of building capacities that ensure resilience and strategic independence. As in a game of chess, you have to think ahead a couple of steps to frighten off some potentially dangerous moves of other players.

In terms of a planetary concern we still have to address the major climate crisis and the last 3 crises have largely contributed to reduce the resources we have available to address climate change. Smart crisis management succeded to ask for emission reductions in return for subsidies from firms and private households. This might be the “best practice examples” worthy to learn from. There are still huge evaluation tasks for analysts of these crises.

Biotop

Die Sensationspresse, zu der leider mehr und mehr ehemals seriöse Zeitungen neigen, zitiert Biotope meistens als Wirtschaftsbremse, Wachstumsverhinderung oder Spaßbremse. Da fällt es schwer dagegenzuhalten. Biodiversität ist nicht umsonst zu haben. Viele Schmetterlingsarten leben bestens angepasst an ihr ökologisches Umfeld, vergleichbar einem Biotop. Farbenpracht dient zur Tarnung im Gelände oder zum Anlocken von Paarungspartnern. Im Botanischen Garten in Berlin werden solche Inseln der Glückseligen für viele Regionen Europas und darüber hinaus nachgestellt. Der frühe Schmetterling von Ende April ist kaum zu bemerken, so gut passt seine Farbkonstellation in sein Umfeld. Es werden richtige Suchbilder und Geduldsproben, die Falter zu entdecken (bitte unten testen). Belohnung lockt für die Geduldigen, wenn das auch vielen von uns unerträglich schwerfällt. Zu schnell sind die Umgebungen für vermeintliche, kurzfristige, wirtschaftliche Interessen zerstört und die angepasste Tierwelt ebenso. Das Bundesnaturschutzgesetz (BNatSchG) intentiert einen Schutz. Der ist aber wohl allzu leicht auszuhebeln. So wird die Farbenpracht und das Tanzen der Schmetterlinge zunehmend in Konzertsälen zu hören oder darüber zu lesen sein, aber seltener in Biotopen zu bewundern sein. Artenvielfalt als Biodiversität braucht die passenden Räume dazu. Eine große Aufgabe bei dem weiteren Anwachsen unserer Spezies.

Bauhaus Haus

Zu den Ursprüngen des “Bauhaus” in Weimar gehört das Haus, welches die Feder von Georg Muche entworfen hat. Auch wenn das Bauhaus überwiegend mit Walter Gropius assoziiert wird, ist die Parallele von Georg Muche zu dem französischen Maler und Architekten Le Corbusier frappierend. Beide waren geprägt durch die eigene Malerei und Zeichenkunst. Die Entwürfe für Häuser oder Villen folgten Zeichnungen, die wiederum einer “cognitive map” mit Prinzipen der Konzeption und der Konstruktion folgten. Treu den Ansätzen des Bauhauses verwirklichte Muche bereits in 1923 sein Musterhaus. Modulare Bauweise, preisgünstige Erstellung, aktuelle Technologie, perspektivische Blickwinkel und Lichtspiel. Eine gewisse Parallelität zu der Villa La Roche und Jeanneret von Le Corbusier besteht nicht nur in der zeitlichen Dimension, sondern auch in dem Einfluß von kubistischem Spiel mit Perspektiven in Haus und auf das Haus. Die von der Malerei herkommenden Architekten entwerfen ihre Räume mit “The painter’s eye“. Vielleicht kommt nicht zuletzt daher der Traum vom Eigenheim, der so prägend bleibt in ganz Europa und der westlichen Welt. Geprägt von den 1910er und frühen 1920er Jahren war kostengünstiges Bauen eine wichtige Rahmenbedingung. Relativ kleine Grundrisse, modular erweiterungsfähig, preiswerte Baustoffe sorgten trotz Schwierigkeiten für rasche Realisierungsmöglichkeiten. Eine gewisse deutsch-französische Parallelität drängt sich auf. LeMonde vom 6.4.2023 beschreibt ausführlich das Dilemma des 21. Jahrhunderts. Der Traum vom eigenen Haus wird für die nächsten Generationen schwieriger zu realisieren sein. Rohstoffpreise, Grundstückspreise, Arbeitslöhne, Kreditzinsen schnellen in die Höhe. Der Traum vom Eigenheim bleibt ein Traum älterer Generationen oder der glücklichen Erben solcher Häuser, fast unerreichbar für Durchschnittsverdienende. “Gemeinsam statt Einsam” ist die noch gültige Schlussfolgerung, die bereits Henning Scherf formuliert hat. Die neue Herausforderung für den Bau war, ist und bleibt die soziale Frage, der wachsenden Ungleichheit entgegen zu wirken.

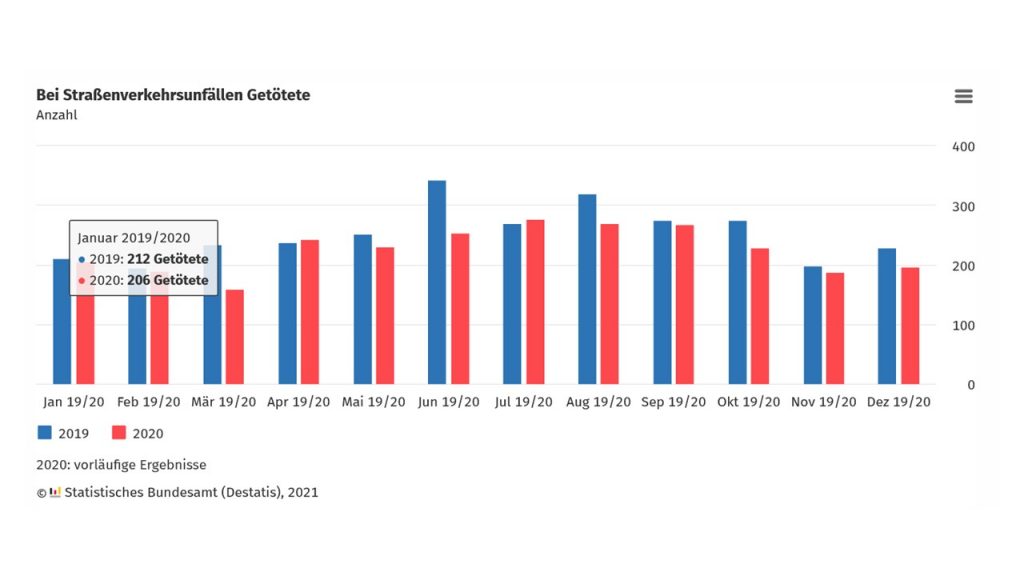

Covid-19 Experiment

Die Corona-Pandemie kann aus unterkühlter, wissenschaftlicher Perspektive mit einem der größten weltweit parallel stattfindenden Verhaltensexperiment gleichgesetzt werden. Welche Personengruppen halten sich an die AHA+L-Regeln (Abstand, Hygiene, Alltag mit Maske + Lüften). Wie reagieren Menschen auf Regelbrüche von anderen. Welches Vertrauen wird der sich mittels Falsifizierung (Popper) weiter-entwickelnden hypothesengeleiteten Wissenschaft entgegengebracht. Wie funktioniert die rasche Übersetzung von Forschungsergebnissen in die tägliche Lebenswelt von Millionen Bürger:Innen. Neben den erschreckend vielen Coronatoten gab es in 2020 jedoch 10% = ca. 30 weniger Verkehrstote in Deutschland. Mit Verkehrsberuhigung und mehr Homeoffice sinken scheinbar auch die Anzahl der Toten auf unseren Straßen. Die Zahlen vom Statistischen Bundesamt legen das nahe. Die saisonalen Effekte korrelieren inetwa mit Lockdownzeiten. Im Sommer kommen die Motorradfahrenden und Fahrradfahrenden vermehrt dazu. In Ländern mit strengerem Lockdown sollten noch weniger Verkehrstote und Verletzte auftreten. Das Verhaltensexperiment, wie eine Tempobeschränkung auf Autobahnen zeigt in einigen europäischen Nachbarländern, dass solche Verhaltensänderungen Leben erhalten. “Die Zahl der Unfälle, bei denen Menschen verletzt oder getötet wurden, ging um 11,8 % auf rund 264 900 Unfälle zurück” schreiben die Statistiker. Mit Willy Brandt würde ich sagen: Nicht nur mehr Demokratie wagen, sondern auch Verhaltensänderungen wagen. Fuß runter vom Gas. Die Pandemie lässt uns fundamental über Gewohnheiten nachdenken. Weniger Verkehr hat auch positive Nebenwirkungen.